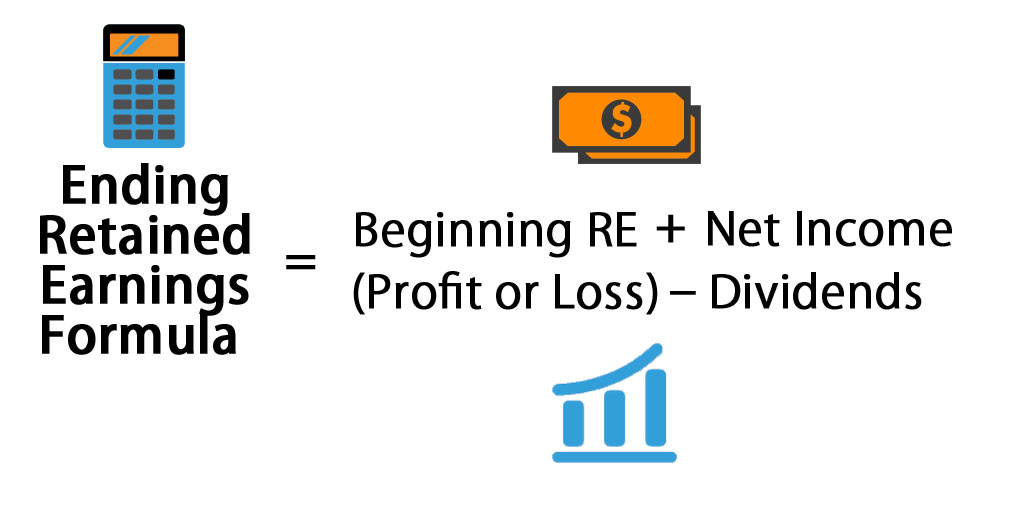

Retained Earnings Entry At Year End . What is a journal entry for retained earnings? beginning retained earnings is the last year’s retained earnings. It’s used when calculating the retained earnings in the current year. retained earnings (re) are the accumulated portion of a business’s profits that are not distributed as dividends to shareholders but. retained earnings (also known as accumulated earnings) is a component of shareholders equity which. How to calculate retained earnings. table of contents. This is the amount of retained earnings carried over from the end of the previous accounting. The journal entry for transferring net income or loss to retained earnings involves.

from www.deskera.com

table of contents. retained earnings (also known as accumulated earnings) is a component of shareholders equity which. The journal entry for transferring net income or loss to retained earnings involves. It’s used when calculating the retained earnings in the current year. How to calculate retained earnings. This is the amount of retained earnings carried over from the end of the previous accounting. What is a journal entry for retained earnings? beginning retained earnings is the last year’s retained earnings. retained earnings (re) are the accumulated portion of a business’s profits that are not distributed as dividends to shareholders but.

Retained Earnings Everything you need to know about Retained Earnings

Retained Earnings Entry At Year End This is the amount of retained earnings carried over from the end of the previous accounting. retained earnings (also known as accumulated earnings) is a component of shareholders equity which. beginning retained earnings is the last year’s retained earnings. This is the amount of retained earnings carried over from the end of the previous accounting. How to calculate retained earnings. table of contents. What is a journal entry for retained earnings? retained earnings (re) are the accumulated portion of a business’s profits that are not distributed as dividends to shareholders but. It’s used when calculating the retained earnings in the current year. The journal entry for transferring net income or loss to retained earnings involves.

From quickbooks.intuit.com

How to Find and Calculate Retained Earnings in 2024 QuickBooks Retained Earnings Entry At Year End How to calculate retained earnings. retained earnings (re) are the accumulated portion of a business’s profits that are not distributed as dividends to shareholders but. The journal entry for transferring net income or loss to retained earnings involves. table of contents. retained earnings (also known as accumulated earnings) is a component of shareholders equity which. beginning. Retained Earnings Entry At Year End.

From www.slideserve.com

PPT Statement of Retained Earnings And Prior Period Adjustments Retained Earnings Entry At Year End This is the amount of retained earnings carried over from the end of the previous accounting. How to calculate retained earnings. retained earnings (re) are the accumulated portion of a business’s profits that are not distributed as dividends to shareholders but. What is a journal entry for retained earnings? It’s used when calculating the retained earnings in the current. Retained Earnings Entry At Year End.

From corporatefinanceinstitute.com

What are Retained Earnings? Guide, Formula, and Examples Retained Earnings Entry At Year End retained earnings (also known as accumulated earnings) is a component of shareholders equity which. It’s used when calculating the retained earnings in the current year. table of contents. The journal entry for transferring net income or loss to retained earnings involves. How to calculate retained earnings. beginning retained earnings is the last year’s retained earnings. What is. Retained Earnings Entry At Year End.

From www.deskera.com

Retained Earnings Everything you need to know about Retained Earnings Retained Earnings Entry At Year End The journal entry for transferring net income or loss to retained earnings involves. retained earnings (re) are the accumulated portion of a business’s profits that are not distributed as dividends to shareholders but. table of contents. retained earnings (also known as accumulated earnings) is a component of shareholders equity which. This is the amount of retained earnings. Retained Earnings Entry At Year End.

From accountingcorner.org

Statement of Retained Earnings Accounting Corner Retained Earnings Entry At Year End retained earnings (re) are the accumulated portion of a business’s profits that are not distributed as dividends to shareholders but. table of contents. How to calculate retained earnings. What is a journal entry for retained earnings? It’s used when calculating the retained earnings in the current year. beginning retained earnings is the last year’s retained earnings. This. Retained Earnings Entry At Year End.

From www.accountingcoaching.online

Understanding Retained Earnings AccountingCoaching Retained Earnings Entry At Year End The journal entry for transferring net income or loss to retained earnings involves. What is a journal entry for retained earnings? How to calculate retained earnings. It’s used when calculating the retained earnings in the current year. retained earnings (also known as accumulated earnings) is a component of shareholders equity which. beginning retained earnings is the last year’s. Retained Earnings Entry At Year End.

From www.vrogue.co

What Are Retained Earnings Guide Formula And Examples vrogue.co Retained Earnings Entry At Year End How to calculate retained earnings. It’s used when calculating the retained earnings in the current year. retained earnings (also known as accumulated earnings) is a component of shareholders equity which. table of contents. beginning retained earnings is the last year’s retained earnings. What is a journal entry for retained earnings? The journal entry for transferring net income. Retained Earnings Entry At Year End.

From exobglozd.blob.core.windows.net

Retained Earnings Definition For Dummies at Jerry Giles blog Retained Earnings Entry At Year End What is a journal entry for retained earnings? retained earnings (re) are the accumulated portion of a business’s profits that are not distributed as dividends to shareholders but. How to calculate retained earnings. beginning retained earnings is the last year’s retained earnings. This is the amount of retained earnings carried over from the end of the previous accounting.. Retained Earnings Entry At Year End.

From www.educba.com

Statement of Retained Earnings Example Excel Template with Examples Retained Earnings Entry At Year End What is a journal entry for retained earnings? This is the amount of retained earnings carried over from the end of the previous accounting. retained earnings (re) are the accumulated portion of a business’s profits that are not distributed as dividends to shareholders but. table of contents. How to calculate retained earnings. It’s used when calculating the retained. Retained Earnings Entry At Year End.

From www.reviso.com

ABC of Accounting The year end closing entries. Retained Earnings Entry At Year End The journal entry for transferring net income or loss to retained earnings involves. retained earnings (also known as accumulated earnings) is a component of shareholders equity which. retained earnings (re) are the accumulated portion of a business’s profits that are not distributed as dividends to shareholders but. How to calculate retained earnings. table of contents. What is. Retained Earnings Entry At Year End.

From www.deskera.com

Retained Earnings Everything you need to know about Retained Earnings Retained Earnings Entry At Year End It’s used when calculating the retained earnings in the current year. beginning retained earnings is the last year’s retained earnings. What is a journal entry for retained earnings? This is the amount of retained earnings carried over from the end of the previous accounting. How to calculate retained earnings. retained earnings (re) are the accumulated portion of a. Retained Earnings Entry At Year End.

From ondemandint.com

Retained Earnings Purpose, Formula & Calculation With Example Retained Earnings Entry At Year End retained earnings (also known as accumulated earnings) is a component of shareholders equity which. The journal entry for transferring net income or loss to retained earnings involves. beginning retained earnings is the last year’s retained earnings. It’s used when calculating the retained earnings in the current year. table of contents. retained earnings (re) are the accumulated. Retained Earnings Entry At Year End.

From corehelpcenter.bqe.com

Checking your retained earnings CORE Help Center Retained Earnings Entry At Year End It’s used when calculating the retained earnings in the current year. How to calculate retained earnings. What is a journal entry for retained earnings? table of contents. The journal entry for transferring net income or loss to retained earnings involves. retained earnings (re) are the accumulated portion of a business’s profits that are not distributed as dividends to. Retained Earnings Entry At Year End.

From www.paretolabs.com

How to Calculate Retained Earnings Pareto Labs Retained Earnings Entry At Year End How to calculate retained earnings. This is the amount of retained earnings carried over from the end of the previous accounting. table of contents. It’s used when calculating the retained earnings in the current year. retained earnings (also known as accumulated earnings) is a component of shareholders equity which. beginning retained earnings is the last year’s retained. Retained Earnings Entry At Year End.

From old.sermitsiaq.ag

Statement Of Retained Earnings Template Retained Earnings Entry At Year End What is a journal entry for retained earnings? The journal entry for transferring net income or loss to retained earnings involves. table of contents. This is the amount of retained earnings carried over from the end of the previous accounting. It’s used when calculating the retained earnings in the current year. retained earnings (also known as accumulated earnings). Retained Earnings Entry At Year End.

From livewell.com

How Do You Calculate Retained Earnings On A Balance Sheet LiveWell Retained Earnings Entry At Year End beginning retained earnings is the last year’s retained earnings. This is the amount of retained earnings carried over from the end of the previous accounting. How to calculate retained earnings. retained earnings (re) are the accumulated portion of a business’s profits that are not distributed as dividends to shareholders but. The journal entry for transferring net income or. Retained Earnings Entry At Year End.

From www.paretolabs.com

How to Calculate Retained Earnings Pareto Labs Retained Earnings Entry At Year End retained earnings (also known as accumulated earnings) is a component of shareholders equity which. How to calculate retained earnings. beginning retained earnings is the last year’s retained earnings. table of contents. What is a journal entry for retained earnings? It’s used when calculating the retained earnings in the current year. retained earnings (re) are the accumulated. Retained Earnings Entry At Year End.

From www.coursehero.com

[Solved] Describe the yearend closing process. What are the four steps Retained Earnings Entry At Year End table of contents. beginning retained earnings is the last year’s retained earnings. It’s used when calculating the retained earnings in the current year. retained earnings (re) are the accumulated portion of a business’s profits that are not distributed as dividends to shareholders but. retained earnings (also known as accumulated earnings) is a component of shareholders equity. Retained Earnings Entry At Year End.